When is a Car Considered Totaled in Hollywood, Florida?

July 15, 2025 – Adam Mann

Car accidents are an unfortunate reality of life, especially in bustling areas like Hollywood, Florida. After a car accident, one of the most pressing concerns for drivers is determining the condition of their vehicle. Is it repairable, or is it considered a total loss? The term “totaled” is commonly used by insurance companies and legal professionals to describe a car that is deemed beyond economical repair.

But when is a car considered totaled, what does it mean, and how can it impact you as a driver?

This blog, from a knowledgeable personal injury lawyer, explores everything you need to know, including the factors that determine a total loss, the role of an insurance company, legal implications, and how Cohen & Cohen Law can assist you with your car accident claim during this stressful time. By the end, you’ll have a clear understanding of how to protect your rights and recover any compensation you need to recover.

What Does It Mean For a Car To Be Totaled?

A car is considered “totaled” when the cost to repair it exceeds a certain percentage of its market value as decided by insurance companies. This threshold varies by state. According to the Florida Statute, a car is legally considered a total loss if the cost of repairs plus the salvage value meets or exceeds 80% of the vehicle’s actual cash value (ACV). The ACV represents the fair market value of the car before the accident, considering its age, mileage, and condition.

For example, if your car’s ACV is $10,000 and the repair costs are estimated at $7,000, your car would be deemed a total loss under Florida law. Knowing this calculation can help you negotiate your claim with your insurance provider.

Note on Salvage Titles

Once a car is declared totaled, it is issued a salvage title by the Florida Department of Highway Safety and Motor Vehicles. This designation signals that the vehicle sustained severe damage and is not roadworthy unless fully repaired and inspected. Salvage titles might lower the resale value significantly, even after repairs.

Factors Determining Whether a Car is Totaled

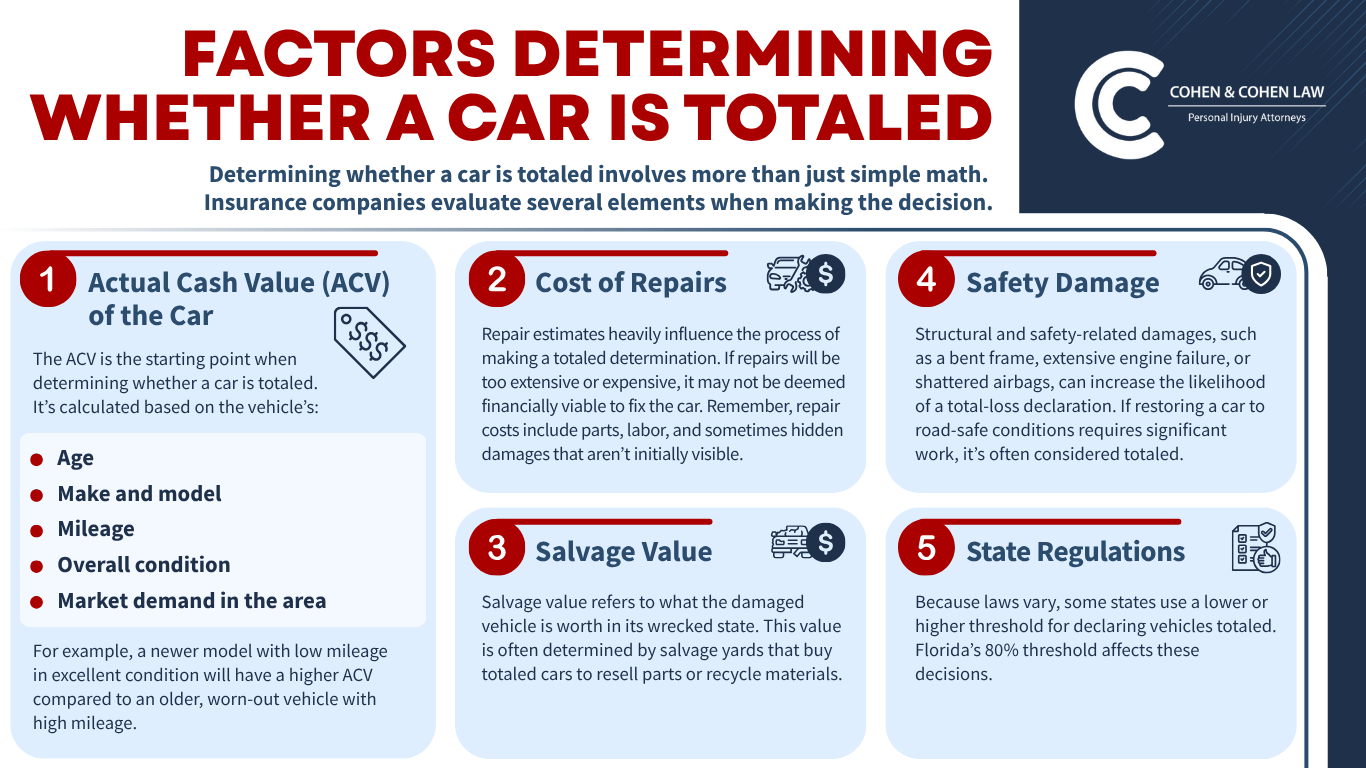

Determining whether a car is totaled involves more than just simple math. Insurance companies evaluate several elements when making the decision.

1. Actual Cash Value (ACV) of the Car

The ACV is the starting point when determining whether a car is totaled. It’s calculated based on the vehicle’s:

- Age

- Make and model

- Mileage

- Overall condition

- Market demand in the area

For example, a newer model with low mileage in excellent condition will have a higher ACV compared to an older, worn-out vehicle with high mileage.

2. Cost of Repairs

Repair estimates heavily influence the process of making a totaled determination. If repairs will be too extensive or expensive, it may not be deemed financially viable to fix the car. Remember, repair costs include parts, labor, and sometimes hidden damages that aren’t initially visible.

3. Salvage Value

Salvage value refers to what the damaged vehicle is worth in its wrecked state. This value is often determined by salvage yards that buy totaled cars to resell parts or recycle materials.

4. Safety Damage

Structural and safety-related damages, such as a bent frame, extensive engine failure, or shattered airbags, can increase the likelihood of a total-loss declaration. If restoring a car to road-safe conditions requires significant work, it’s often considered totaled.

5. State Regulations

Because laws vary, some states use a lower or higher threshold for declaring vehicles totaled. Florida’s 80% threshold affects these decisions.

Hollywood Car Accident Attorneys Explain the Role of Insurance Companies in Determining a Total Loss

Insurance companies are the main decision-makers when it comes to determining whether your car is a total loss after an accident in Hollywood, Florida.

Initial Assessment and Claim Filing

The first step after an accident is to file a claim with your insurance provider. They will send an adjuster to assess the damage and determine repair costs. Take detailed photos of your car immediately after the accident as evidence to support your case if you disagree with their appraisal.

Adjuster Evaluations

Insurance adjusters evaluate:

- The extent of damage

- Costs of repairs at certified shops

- Salvage value of the vehicle They will then compare these numbers to the car’s ACV.

Setting Settlement Amounts

If your car is declared totaled, the insurance company will offer a payout. This settlement equals the ACV minus your deductible. For example, if your car’s ACV is $10,000 and your deductible is $1,000, you’ll receive $9,000. If the settlement amount feels inaccurate, you have the right to negotiate or consult a car accident lawyer to assess the fairness of the offer.

Legal Implications in Florida

Disputing a Totaled Car Verdict

If you believe the insurance company undervalued your car, you can challenge their valuation. Hiring an appraiser or seeking legal assistance from a Florida car accident lawyer can strengthen your case. At Cohen & Cohen Law, we’ll assess your accident to prevent your insurance company from shortchanging you.

Liens on the Vehicle

If you’re still making payments on your car loan when it’s totaled, the insurance payout will go toward settling your outstanding loan balance first. In cases where the payout is lower than the loan amount (negative equity), you’ll still owe on the loan. Gap insurance may help cover this difference.

Filing a Personal Injury Claim

A car accident often inflicts more than just property damage. If you sustained serious injuries in the accident, working with a personal injury law attorney can help you recover compensation or medical bills, lost wages, and pain and suffering. Cohen & Cohen Law specializes in handling personal injury cases, offering personalized strategies for our clients.

Personal Injury Protection

As a no-fault state, Florida requires every driver to carry at least $10,000 in personal injury protection (PIP) insurance to pay for their medical bills and lost wages. Its primary goal is to minimize the delays and complications associated with determining fault after an accident. By providing immediate compensation for medical treatment and other financial losses, PIP alleviates the financial burden on accident victims and expedites access to needed care.

PIP in Florida usually covers:

- Medical Expenses: Up to 80% of the claimant’s medical bills, such as hospital stays, medication, surgery, and rehabilitation, up to the policy’s limit.

- Lost Wages: PIP may cover a portion of lost income if the injured party cannot work due to injuries sustained in the accident.

- Replacement Services: Compensation for costs associated with hiring help for household tasks the injured party can no longer perform.

- Funeral Expenses: Provides limited coverage for funeral costs in the event of a fatality.

Uninsured and Underinsured Motorist Coverage

If the at-fault driver lacks adequate insurance, you may need to rely on your uninsured or underinsured motorist (UM/UIM) coverage. This component of Florida auto insurance protects drivers when the at-fault party has little or no insurance.

What It Covers

UM/UIM coverage pays for expenses related to accidents caused by drivers who either lack insurance or whose insurance limits are insufficient to cover the damages, including

- Medical Expenses: Coverage for hospital bills, surgeries, rehabilitation, and other necessary medical treatments.

- Lost Wages: Compensation if injuries prevent you from working.

- Pain and Suffering: Covers physical and emotional distress resulting from the accident.

- Additional Costs: Expenses like long-term care, physical therapy, or any other needs that arise due to serious injuries.

Why It’s Important

Even though Florida law mandates Personal Injury Protection (PIP) insurance, its $10,000 limit often falls short in severe accidents. If the other driver is uninsured or underinsured, UM/UIM coverage bridges the gap, to ease the financial burden caused by someone else’s negligence.

How It Protects You

UM/UIM coverage protects car accident victims by:

- Giving you access to funds for necessary treatment and recovery when the responsible party lacks adequate coverage.

- Providing financial support for severe injuries that exceed standard policy limits.

- Offering peace of mind, knowing you’re covered even in unforeseen and challenging situations.

Securing uninsured and underinsured motorist coverage is a wise step for Florida drivers striving to safeguard their physical and financial well-being.

Common Injuries from Car Accidents

Car accidents can cause several types of injuries varying in severity depending on the circumstances of the crash. Below are some of the most common injuries suffered by car accident victims:

- Traumatic Brain Injuries (TBI): These occur when a sudden impact or force damages the brain. TBI can lead to symptoms ranging from mild concussions to severe cognitive impairments, impacting the victim’s ability to perform daily tasks.

- Spinal Cord Injuries (SCIs): Damage to the spinal cord can result in partial or complete paralysis, making recovery a long and intensive process. This type of injury often requires extensive medical care and rehabilitation.

- Whiplash: A common neck injury where the head is abruptly forced forward and backward, straining the muscles and ligaments. While it might seem minor, whiplash can cause chronic pain and restricted mobility.

- Broken Bones: Fractures of the arms, legs, ribs, or pelvis are frequent in high-impact collisions and usually require surgical intervention and recovery time.

- Internal Injuries: Blunt force trauma can injure organs like the liver, spleen, or kidneys, often requiring emergency medical treatment to prevent life-threatening complications.

- Burns and Lacerations: Contact with hot surfaces, fires, or shattered glass can leave victims with burns or deep cuts, some of which may result in disfigurement or scarring.

By understanding these potential injuries, car accident victims can better prepare for the medical and legal actions they may need to take.

Compensation Car Accident Victims Can Pursue in a Personal Injury Lawsuit

Car accident victims in South Florida often face a challenging recovery process, but understanding the compensation options available through the legal system can provide clarity and financial relief. Here’s what an injured party can pursue in a personal injury lawsuit:

- Medical Treatment Costs: This covers all expenses related to the injuries sustained, including hospital stays, surgeries, medication, and follow-up care.

- Rehab Costs and Physical Therapy: Victims often need long-term rehabilitation or physical therapy to recover their strength and mobility.

- Lost Income: If injuries prevent the injured party from working, they may seek compensation for lost wages and, in severe cases, a loss of earning capacity.

- Pain and Suffering: This includes financial compensation for the emotional trauma and physical pain endured due to the accident.

- Property Damage: Victims can recover the cost of repairs or replacements for their vehicle and other personal belongings damaged in the crash.

- Ongoing Medical Care: If the injuries require long-term or permanent medical support, compensation can address these future needs.

- Loss of Enjoyment of Life: Injuries that impair day-to-day activities, hobbies, or overall quality of life can warrant additional compensation.

- Wrongful Death Damages: For fatal accidents, surviving family members can pursue compensation for funeral costs, loss of companionship, and emotional grief caused by the responsible parties through a wrongful death lawsuit.

- Legal Fees and Claims Process Costs: Victims may also claim expenses incurred during the claims process, including legal representation and court fees.

By pursuing these forms of compensation, car accident victims can work towards securing their financial stability while navigating the often-complex claims process with the help of experienced legal professionals.

How a Car Accident Lawyer from Cohen & Cohen Law Can Help

Handling the aftermath of a Hollywood car accident can be overwhelming, especially when dealing with insurance adjusters, legal processes, and repairs. At Cohen & Cohen Law, our compassionate and committed team is ready to guide you through every step of the process.

- Personalized Legal Strategy: We take time to understand your unique case, tailoring our approach in seeking your best outcome.

- Transparent Communication: You’ll stay informed every step of the way with open and honest updates, so you’re never left in the dark.

- Compassionate Advocacy: Your well-being is our priority. We fight tirelessly to recover compensation and help you move forward.

Our experience handling car accidents and personal injury cases makes us a trusted choice for legal representation in Florida. You don’t have to face this alone.

Frequently Asked Questions About a Car Accident Claim Involving Property Damage & Personal Injuries

1. How does Florida’s 80% rule work for totaled cars?

Under Florida law, a car is considered totaled if the cost of repairs plus the salvage value equals or exceeds 80% of the car’s ACV. For instance, if your car’s ACV is $10,000 and repair costs come to $8,000, the car would be declared a total loss.

2. Can I keep my car if it’s totaled?

Yes, Florida law allows you to retain ownership of a totaled vehicle. However, the payout from your insurance company will be adjusted to reflect the car’s salvage value. You will also need to apply for a salvage title and ensure the car is roadworthy before driving it again.

3. What if I disagree with my insurance provider’s valuation?

You have the right to dispute the insurance company’s assessment. Start by gathering evidence, such as photos, repair estimates, and an independent appraisal. Contact a Florida car accident lawyer to help you negotiate or escalate the matter legally.

4. Does Florida require gap insurance?

Gap insurance isn’t required in Florida but is highly recommended for drivers who owe more on their car loan than the vehicle’s ACV. It helps cover the gap between what you owe and the insurance payout in the event of a total loss.

5. What happens if the other driver is at fault but uninsured?

If the at-fault driver doesn’t have insurance or sufficient coverage, your uninsured or underinsured motorist coverage can help. We recommend reviewing your policy limits and consulting a personal injury lawyer from Cohen & Cohen Law to explore compensation options.

6. How long does it take to settle a totaled car claim?

The timeline can vary depending on the complexity of the claim. With proper documentation and cooperation, most claims are resolved within a few weeks. Hiring an experienced personal injury lawyer can expedite the process when disputes arise.

7. What other losses can I recover after a car accident?

Beyond car repairs, you may recover damages for medical bills, lost income, rental car expenses, pain and suffering, and emotional distress. For more than 55 years, Cohen & Cohen Law has focused on pursuing fair compensation for clients throughout South Florida.

8. Do I need an experienced personal injury lawyer for my car accident case?

While not mandatory, hiring a Florida car accident lawyer can significantly improve your chances of receiving fair compensation. Legal professionals can handle disputes, negotiate with insurance adjusters, and represent you in court if needed.

9. How do I document damage after an accident?

Capture high-quality photos of the vehicle, focusing on damaged areas, VIN numbers, and license plates. Collect repair estimates and gather police reports to support your claim.

10. What does it cost to hire Cohen & Cohen Law after an auto accident?

At Cohen & Cohen Law, we operate on a contingency fee basis, which means you owe us nothing unless we win your case. We offer a free consultation to discuss your motor vehicle case, where we thoroughly explain your options before you commit. Our law firm can also refer you to the right medical professionals to aid in your recovery.

Cohen & Cohen Law Provides the Experience You Need and the Representation You Can Trust

A totaled car is a financial and emotional burden, but you don’t have to face it alone. Cohen & Cohen Law provides the legal support you need during this difficult time. From communicating with insurance companies to representing you in court, we’ll help you reclaim your peace of mind and focus on your recovery while we pursue maximum compensation under FL personal injury law.

Contact us at (800)-33COHEN(800)-33COHEN or complete our online form to schedule a free consultation with a dedicated Florida car accident lawyer.

Copyright © 2025. Cohen and Cohen Law. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

Cohen and Cohen Law

4000 Hollywood Blvd penthouse 705s

Hollywood, FL 33021

(800)-33COHEN(800)-33COHEN

https://www.cohenandcohenlaw.com

Take Action Now – Speak to Your Attorney &

Seek the Settlement You Need

Contact Us Today For a Free Case Consultation

Required Fields*

Your Information Is Safe With Us

We respect your privacy. The information you provide will be used to answer your question or to schedule an appointment if requested.